By David McMahon on 5/9/2021

See how retailers can use CXM to automate sales and service processes. It uses automation triggers to save time and produce meaningful results quicker.

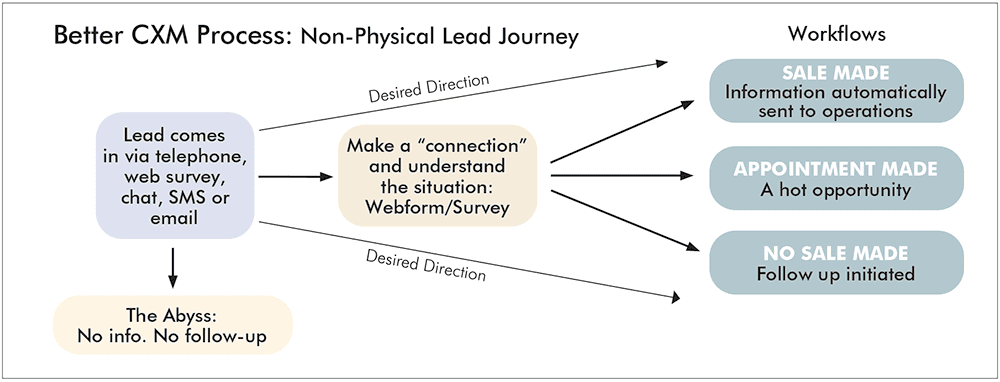

In the March/April 2021 issue of Furniture World, the concept of Customer eXperience Management (CXM) was introduced. CXM can help retail furniture stores better manage leads, and improve systems and processes to increase employee productivity, as well as boost metrics such as close rates and average sales. In that article, an example was given of how a typical non-physical lead journey can work to produce increased sales and happier customers and salespeople. This installment will continue with examples of how CXM works by focusing on lead management workflows that benefit your retail operation.

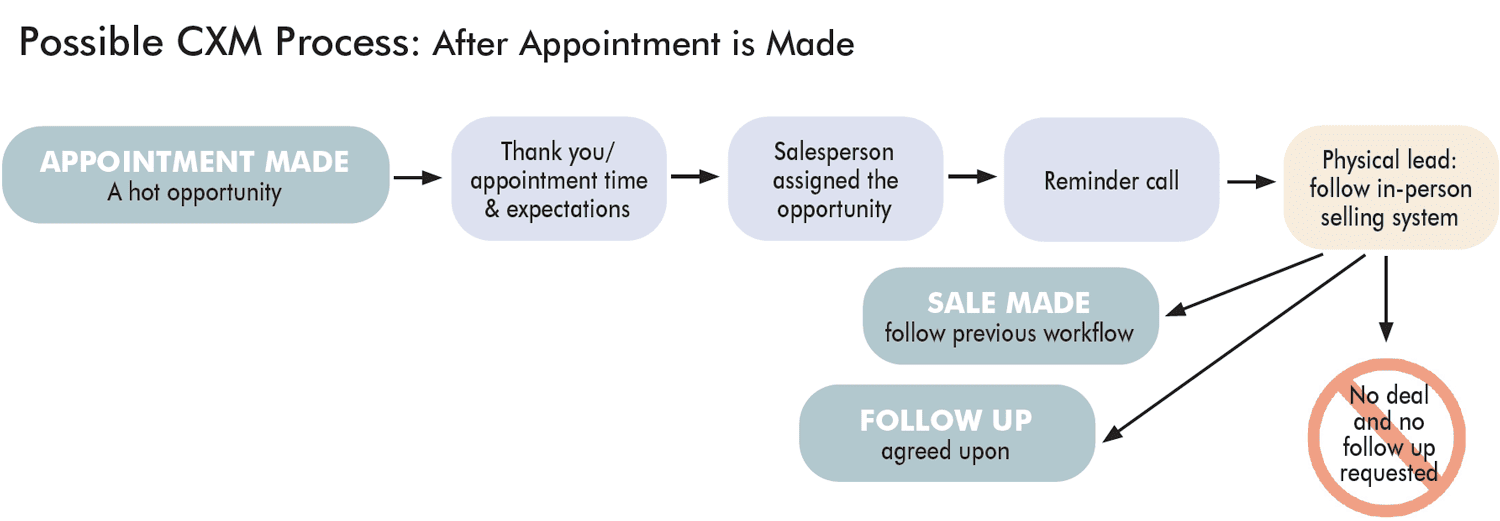

CXM Workflow: Appointments

Lead Managers working in formal business development centers, or BDCs, are tasked with supplying salespeople with a steady stream of warmed-up and qualified customers. One goal for lead managers is to schedule customer appointments with sales and design associates. The purpose is to get both customers and salespeople to commit to providing a valuable resource—their time. Commitment to appointments sets hot leads apart from semi-serious leads. Here is a possible workflow process:

- Step #1. Booking: Book the appointment on a digital calendar. You cannot count on customers or salespeople to write down and remember all their appointments.

- Step #2. Automated message: . Send an automated thank you message (text and email) with the time and date agreed upon. In the message, let each customer know how to prepare for the best in-store experience. For example, pictures of their room, existing furniture and accessories, measurements, and samples of styles they like. Perhaps even include a short survey. This pre-work can really move the process along.

You might be thinking that this is a lot of time-consuming preparation. Also, you may not be confident that your employees will do this in an efficient manner and say the right things. My answer is that you are right! That is why you need to rely on good CXM systems and processes. Start by preparing message templates for salespeople to use. These professional communications can be automatically triggered. CXM moves customers along their journey and relies less on salespeople and sales support performing every small task along the way. It helps them to consistently do their work exceptionally well. So, once steps #1 and #2 above are completed, here’s what’s next.

To be efficient, communications need to be simple and frequent—an automatic process that does not hold the organization back in terms of workload. |

- Step #3. Reminder Call: After a salesperson is assigned the lead, a reminder call can be triggered so everyone can be better prepared for a successful conclusion of a face-to-face or virtual appointment.

- Step #4. Pre-work for the salesperson/designer: Salespeople should review all information received from the lead manager and customer,, so that they can better understand the situation and focus in on appropriate options. For example, a welcome gift might be appropriate. Knowing in advance if a shopper would like to be served coffee, beer or wine can provide an unexpected and welcome surprise.

- Step #5. In-store visit: If you’ve prepared properly, your salespeople will be miles ahead already. You will find that as they progress through your regular selling system, the process will progress smoother with these warmed up and committed customers.

- Step #6. The outcome: most of the time, leads handled this way will turn into sales. But sometimes they will require additional follow-up, like house calls that achieve high close rates. Either way, good CXM processes branch off from here.

- Step #7. New order: When a sale is made, a new order follow-up workflow should be initiated.

- Step #8. Other follow up: If a house call appointment is made or some other follow-up is agreed upon, a similar process of scheduling on the calendar continues.

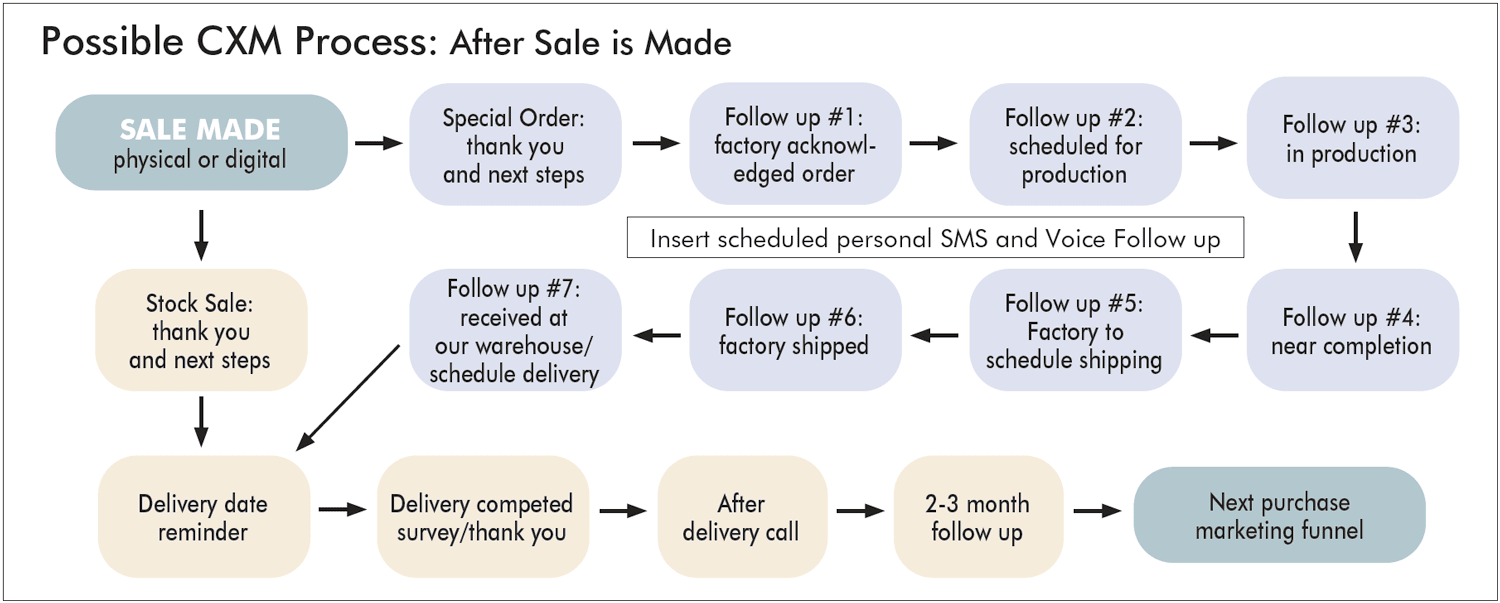

CXM Workflow: Sale Made

Two types of workflows occur after a sale is made. Either the merchandise needs a PO sent to the vendor or the inventory required is in stock. Either way, if you want to deliver the best customer experience you need to keep in touch with customers through the entire fulfillment process. This is especially true with special order items. Customers deserve to be contacted frequently even if there is nothing new to report. Think of good reasons to keep in touch via text, email or with a call.

The first contact should be a thank you and perhaps a review. This can be followed up with either a delivery or pick-up reminder, or in the case of special order, a message that the vendor received the order, for example. Put yourself in your customer’s shoes: if you spent several thousand dollars and received only a promise, would you rather be contacted more often or not at all? Retailers receive a significant number of order status requests from customers who are, especially now, waiting a long time for delivery.

This volume of status requests tends to interrupt employees, who may feel overburdened and less able to perform other important job duties. To avoid this situation, retailers need to follow-up routinely and often. Look to automation. CXM involves setting triggers that automate follow up and reminders to follow-up.

Other examples of special order follow-up messages that can be sent to customers are:

- Merchandise is scheduled for production

- Merchandise is in production

- Near completion

- Factory to schedule shipping

- Factory shipped

- Merchandise received at our warehouse and delivery or pick-up date suggested

Once delivery is complete, post- delivery calls or messaging is important. And CXM does not stop there—it continues on, hopefully guiding the customer into future purchases.

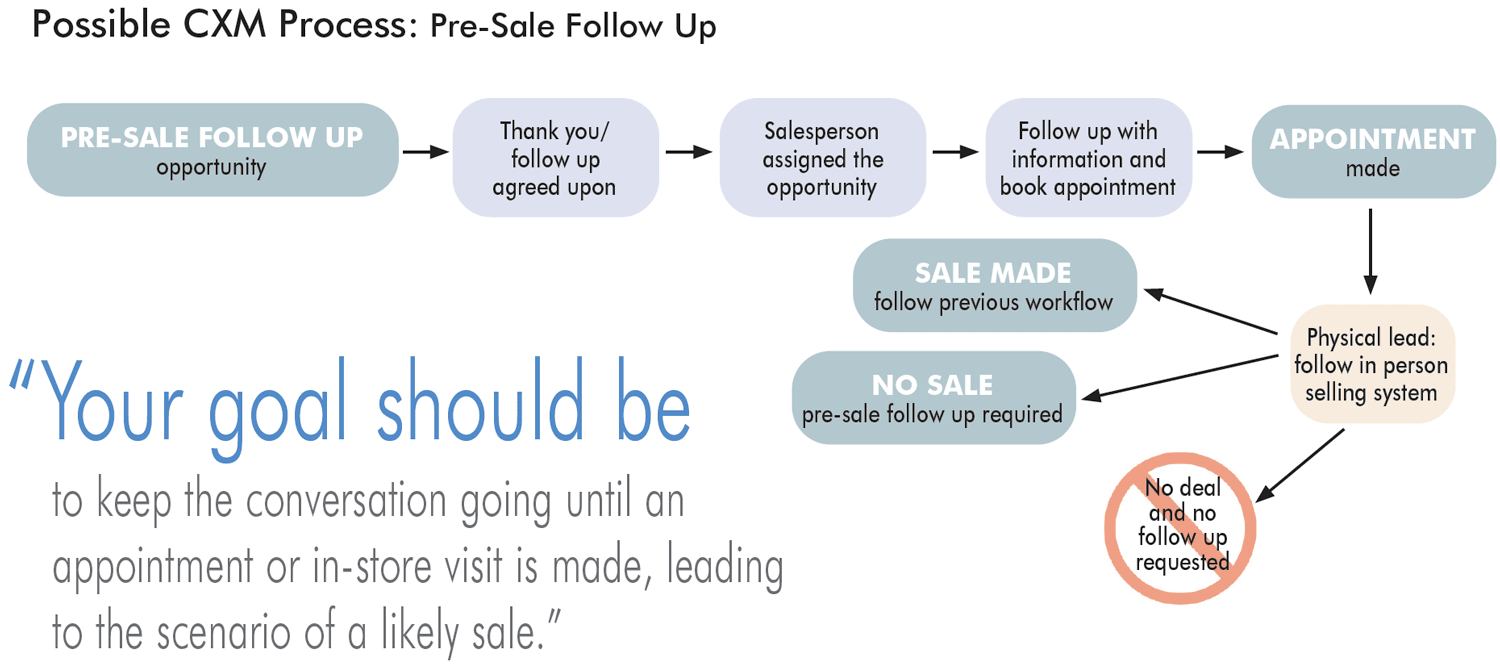

No Sale, Follow-Up Required

This third workflow example occurs when neither an appointment or sale is made. If a salesperson or lead manager collects a customer’s information, a foolproof system to ensure follow-up needs to be put in place. When retailers do this properly, virtual or physical leads will build up.

A retailer who wants to maximize sales volume and its reputation in the community can’t drop the ball on qualified leads. Automate a thank you message immediately after the interaction allowing for these messages to be customized to include any necessary details such as a request for additional information to move the prospect along in their purchase journey. You do not want them to shop at another store that has better follow-up, right? Of course not. Your goal should be to keep the conversation going until an appointment or an in-store visit is made, leading to the scenario of a likely sale.

Customer Service Issue

There are countless ways CXM can improve an organization. I will present one more in this article. Customer eXperience Management can be used to streamline customer service issue resolution.

A request for customer service often starts with a call from a customer who has a problem. Unfortunately, the employee on the receiving end of the call is rarely prepared to resolve the issue and needs to get back to the customer later. This is inefficient and a time waster.

These service complaints can pile up. Do not expect your employees to develop their own perfectly organized systems, software, and processes. It is management’s responsibility to continually improve business processes so employees have clear paths to follow.

A great way to do this and provide a better experience for your customers is to create a service form on your website. This form can be filled out by either customers or employees. Why a form? Because in nice little boxes it records the necessary information needed to diagnose a problem and find the best solution as quickly as possible. With good CXM, the form will automatically create a ticket and email it to the people who are tasked with managing and resolving the issue.

This ticket acts in a way that’s similar to how customer leads are sent to salespeople. With service though, the desired outcome is a satisfied customer and productive employees. At the same time a virtual ticket is created, the service manager is notified and the customer gets a message letting them know about the next steps. Based on the information received, the service manager can respond fast. This response could be an immediate resolution, sending a tech or ordering a part, referring to the accident protection company, or getting additional information. In any case, the customer is in the loop and in most cases their issue is managed better.

Other CXM Workflows

There are many other ways to organize a CXM to improve customer experiences. Here is a short list:

- Accident protection purchase reminder

- Next purchase ideas

- Related item follow-up

- Anniversary of last purchase

- Birthday gift

- Social media lead generation for lead forms

- Chat lead generation

- In-store digital ‘register to win’ forms

- Quote follow-up

- Past purchase follow-up

- Vendor communication tracking

- Internal education and learning management

Unlimited CXM Possibilities

To sum things up, Customer eXperience Management helps organizations by improving processes, which always equals better outcomes for both businesses and customers. CXM helps customers move more effectively and efficiently through their shopping journey.

This includes selling processes for both non-physical and physical operations such as managing sales before merchandise delivery, purchase follow-up and delivery scheduling. CXM can also be used to enhance the journey with respect to service issue resolution or marketing to attract new customers. Not only does it create better word-of-mouth (WOM) marketing through your customers’ networks, it allows you to create automated, relevant and customized touchpoints for another purchase down the road.

The automation is released by triggers to save employee time and produce meaningful results quicker. Finally, the added benefit of well designed CXM systems and processes is that you can integrate and add more horsepower to your other systems such as your POS system, Podium, Dispatch Track, in-store traffic counters and website partners. Tying this all together provides a powerful customer facing solution for your business.

Next Steps

If you are intrigued by the possibilities of CXM I recommend that you:

- Review your current processes with regards to just one area of your business to start, for example, lead management.

- Next, follow the chain of events and then ask, “Are we delivering the best customer experience in our market or are we trying to make people happy?” Furthermore, ask, “Are we efficient with our time?”

- Then finally, seek out the best processes, systems, and people to continually develop Customer eXperience Management.

About David McMahon: David McMahon is founder of PerformNOW Inc. PerformNOW has three main products that help home furnishings businesses improve and innovate: Performance Groups (Owners, Sales managers, Operations), PerformNOW CXM (Customer eXperience Management systems and processes), Furniture business consulting. Your can reach David at david@performnow.com.