Published in:

Furniture World Magazine

Volume 149 NO.5 September/October

By David McMahon on 9/29/2019

This sales formula for growth will help you take actions that will directly impact the strength of your retail business.

One of the most common questions I get from my retailer clients is, “How are businesses doing out there?” They often add, “I’ve heard that it is tough for many retailers, business is flat, and few are growing.”

My response has remained pretty much the same over the past many years. Aside from during the great recession, many businesses in retail have been flat. However, there are some that have managed to grow significantly.

Why do some retailers grow, while others plateau or decline? This article will answer that question and hopefully help some of you get out of a rut and start to grow again.

The purpose of marketing is to increase customer engagement to then grow sales. Keeping that in mind, the most recent article in this series (July/ August 2019 issue, “Marketing Effectiveness Metrics Marketing“), looked at tracking customer traffic in three ways:

- By new customers

- By repeat customers

- By personal trade repeat customers

Soon after the article was published, I heard a podcast interview with Kevin Systrom, the founder of Instagram. You can find it at (https://mastersofscale.com).

Systrom presented his formula for growth. “It’s how many new people came in the door, how many people decided to stop using you, and then how many people who used to use you decided to use you again. Plain and simple, those three terms equal net growth,” he said.

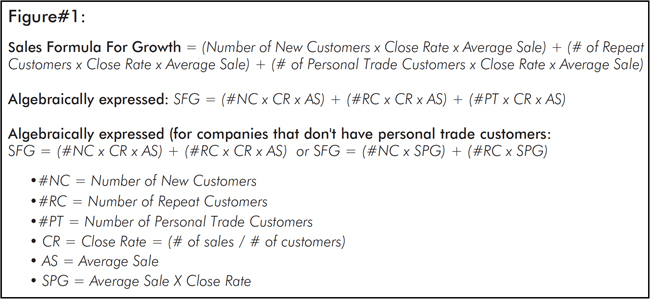

Given that it is difficult to track which customers “have left you and then decided to come back to you”, the idea presented in the previously mentioned July/August article of counting traffic as a driver of growth seems worthy. And, to make this traffic counting meaningful, retailers should track average sale and close rates by the three categories of traffic that are New Customers, Repeat Customers and Personal Trade Customers. The reasoning for this is that there are different strategies and likely different ROI’s depending on each customer relationship.

The Formula

With all this in mind, my sales formula for growth is expressed in Figure #1 below.

This is in contrast to how many retailers in our industry measure growth. They use the simple formula for change: (Sales Now – Sales Before) / Sales Before. This is OK, however, by just using this change formula, the underlying reasons for growth remain mostly guess work.

Salespeople & Capacity

Most furniture retailers’ business models rely exclusively on salespeople serving customers. Experience has shown that individual salespeople can improve but, as a whole, a sales force can do so only marginally. This has to do with capacity. The capacity per salesperson is the average sales per salesperson dictated by your business model. Sure you may have a person who writes $1.5 million per year. But, you likely cannot find a way to bring everyone on your sales team up to that level. It’s just not the way averages work. With this in mind, if you have five salespeople and your average is $650,400 per salesperson, your sales are $3.25 million per year.

Yes, you can improve. However, those retailers that really grow their furniture businesses, add additional salespeople, find ways to get them customers, and achieve the same or better sales / salesperson averages.

| Those retailers that really grow their furniture retail businesses, add more salespeople to their companies, find ways to get them customers, and achieve the same or better sales/ salesperson averages. |

Expanded Formula

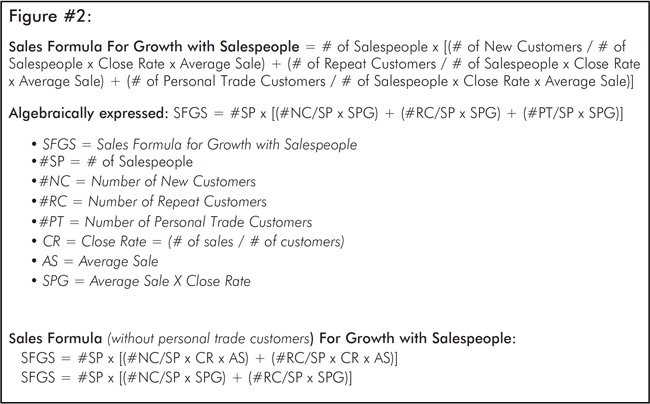

Since sales force growth is integral to company growth, the “sales formula for growth” is amended in Figure #2 above to include the number of salespeople. Also, if you prefer to track sales per guest (SPG), you can substitute SPG for AS x CR (average sale x close rate in Figure #2.

Ways Businesses Grow

Before you start making predictions on the economy, or the internet and the way people shop (which do play a part, but in which you have little control), consider these 5 questions:

- Has the number of salespeople you employ grown?

- Has the number of stores you operate or categories you offer expanded?

- Has your business model been improved?

- Has the mix of your team been improved?

- Have your management team and systems improved?

Adding one salesperson,

and taking steps to increase the average monthly sales per salesperson helped this business go from habitually flat to growing.

When “no” is the answer to many of these questions, you are unlikely to have experienced substantial growth.

Another factor that affects business growth is when other businesses decide to grow in your market area before you. When competitors for your customers’ share-of-spend are answering “yes” to the above five questions, they will hurt your growth potential.

Below is a list of some actions that commonly result in growing volume:

- Adding salespeople and staffing properly to existing traffic

- Adding salespeople and staffing properly to desired sales goals

- Decreasing employee turnover

- Adding retail locations

- Adding categories

- Adding new marketing programs

- Increasing customer follow-up

- Changing the business model

- Changing employees

- Changing managers

- Changing locations

- Changing the marketing mix

- Changing merchandising and/or display presentations

- Changing and improving on systems and procedures to make selling easier.

Aside from decreasing employee turnover, all the growth actions start with add, change, increase, or improve. There are few actions that would result in sales growth that start with cut, reduce, do less, or do the same thing.

Case Example

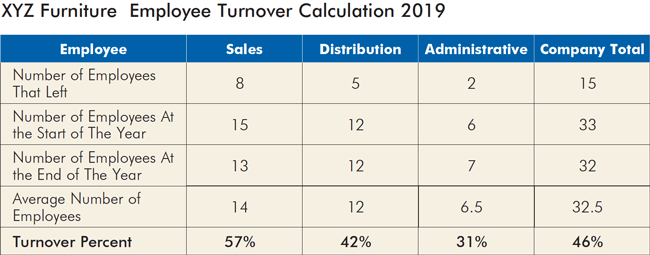

Let’s look at a quick case example and apply my sales formula for growth with salespeople (SFGS). Let’s take the case of a business we will call XYZ, stuck at $3.25 million dollars in annual sales volume. This furniture retailer employed five salespeople on average, was good at counting traffic and had a functioning opportunity counting system that tracked close rates, average sales, and SPG by customer type. The company had tried sales training, changing managers, tweaking their selling system and changing up the marketing mix. These actions moved the needle initially. But eventually, they ended up right back where they started. The sales training seemed to have little effect on results in the long run because salesperson turnover was too high. Year after year they could not beat an average sales number of $650,000 per year, $54,000 per month per salesperson. Finally, XYZ’s owner decided enough was enough and did three things:

- Mandated and managed the use of a selling system that was part of the sales training they invested in.

- Increased and systematized their customer follow-up.

- Added 1 salesperson (averaged 6 at all times).

After one full year of operating this way, this is what happened:

Customer traffic increased by 50 people per month and salesperson turnover dropped. The store’s average salesperson per guest metric improved. The average monthly sales per salesperson increased marginally from $54,000 per month per salesperson to $56,000. Annual sales per salesperson increased from $650,000 to $672,000 per year. These steps helped this business grow from $3,252,500 million in sales to $4,032,000. That’s a 24 percent increase in sales volume (See Chart #1 below).

For retailer XYZ, adding one additional salesperson and taking steps to increase the average monthly sales per salesperson helped this business go from habitually flat to growing.

Improvement starts with understanding your situation better, making decisions to improve that situation, and then executing those improvement actions.

David McMahon is a retail financial and operational professional and Founder of PerformNOW. He directs multiple consulting projects, is proud to lead 6 business mastermind performance groups: Ashley Gladiators, Kaizen, Visionaries, TopLine Sales Managers, Lean and Sigma DC Operations. He is Certified Management Accountant and Certified Supply Chain Professional. You can connect with David at:

https://www.linkedin.com/in/davidwmcmahon/ or david@performnow.net.