Furniture World Magazine

Volume 150 NO. 4 July/August

By David McMahon on 8/4/2020

The new front door was not invented during the pandemic; however, it has become critically important for furniture retailers over the past few months.

COVID or not, it is well known that the customer’s purchasing journey most often starts before going into a physical location. In the May/June issue of Furniture World (www.furninfo.com/Authors/David_McMahon/6) we characterized this as the “New Front Door.”

Lead Traffic

Because consumers are spending much more time in their homes, many home furnishings retailers have seen increases in lead traffic. It comes from multiple sources, including email, telephone, social media, as well as text, chat, video, website triggers and in-store traffic. Some businesses have become hard pressed to handle this increase due to compromised human resources and outdated processes. It is also true that even before the crisis, furniture retailers were mostly not up to the task of handling even a smaller amount of non-physical customer engagements properly. This retail condition is not anyone’s fault. It is a classic case of retailers doing things the same way as always because those things “kinda” worked.

Better management of all lead traffic is a sizable opportunity in retail. In this article I will discuss the customer journey, challenges retailers face, and explore ways to better manage the process so that Furniture World readers can achieve higher sales volumes and more satisfied customers.

Challenges

The challenge starts with the fact that retailers use a variety of marketing methods to attract customers. These methods include traditional ads—for example, TV, print, Facebook and Instagram—plus search ads, email marketing, and a variety of website plug-ins. Then, when customers like what they see, or are just “in-the-market,” they will either transact online or attempt to reach out to retailers using the methods that they are most comfortable with. These include phone calls, emails and text chats.

That all sounds great in theory, but there are common difficulties.

Retailers that rely to a large degree on their brick and mortar business generally do not have business models and processes in place to handle non-physical customer leads. Their processes are entirely built upon salespeople “taking an up” once shoppers enter the building. Inquiries received via retailers’ “new front door” are not counted as “real” leads and are even seen as an interruption by some.

Even though leads received through this “new front door” signal the start of a customer’s journey, and her engagement with a retailer’s marketing, these engagements are often mismanaged. Here is an example of a typical interaction:

- A prospect calls the retailer.

- The prospect hears an auto message asking them to press a number, or any staff member who is free at that moment answers the call.

- If the first person who talks to the customer is not in “the sales department” he or she places the customer on hold while a salesperson is paged, or they try to muddle their way though the call.

- Once a salesperson is located, the prospect asks a question and then receives a short answer from the salesperson. There is little attempt to understand the customer’s situation. If the retail store is busy, the salesperson cannot take the necessary time to even record the prospect’s name, contact method or where they live.

- Call ended. The lead is not recorded. There is no possibility of follow up. The store does not find out what happened to the prospect— if they visited the store or if they made a purchase.

The same issues also occur with email inquiries, chat, and text. The main difference is that with written communications, stores often respond with poor spelling and bad grammar. Across the board there is a lack of attention, qualifying, tracking and follow up.

The Opportunity

If you agree that there is an opportunity to improve the way you handle these kinds of customer inquiries, look at your processes and people. The first question to ask is “Exactly what is it worth overall for your organization to improve your lead management process?”

Terms like digital salesperson, internet salesperson and phone operator understate the importance of the function and what retailers are trying to accomplish. |

Running through the numbers for a store we will call XYZ Furniture, let’s assume:

- The typical close rate for XYZ Furniture’s physical store is 30 percent. (This usually varies between 15-40 percent).

- The typical average sale for XYZ Furniture’s physical store is $1,800. (This can range between $500 and$5,000).

Using the formula…

Monthly Leads x Close Rate Increase x Average Sale Increase x 12 months = Annual Sales Opportunity

… we see that 100 extra leads in the store is worth $54,000 per month or $648,000 per year in extra sales (100 leads x .3 close rate x $1,800 x 12 months).

However, if I stated that this was the limit of the opportunity of improved customer journey management, I would be wrong. That’s because better lead management also produces higher close rates and higher average sales. This has been proven over the past few months by the many stores that operated via appointment during and after physical shutdowns. Close rates from well-managed non-physical leads range from 60-100 percent with average sale increases of hundreds of dollars. Extrapolating on the opportunity of 100 leads per month using these assumptions, the revised calculations for sales growth using the formula above can be calculated as follows:

One hundred extra leads in the store at a 70 percent close rate and $2,000 average sale equals $140,000 in sales per month or $1,680,000 per year in additional business.

Making it Happen

Any innovation starts with a new way of thinking. The process of organizational change needs to be accepted. Here are some new ways of thinking that can help you manage your customer journey to capitalize on incoming leads.

- Change terminology.Terms like digital salesperson, internet salesperson and phone operator understate the importance of the function and what retailers are trying to accomplish. My suggestion is to reclassify them under the banner of Customer Journey Management or Customer Lead Management. I have witnessed showroom salespeople who believe that internet sales are in direct competition to their retail in-store sales. The reality is that journey management done right supports revenue for the entire organization.

- Put one person in charge.Give them a title. The title might be Director of Customer Journey, Prospect Manager or Head Lead Manager. If many people are responsible for handling incoming (non-physical) leads, the reality is that no one will ultimately be responsible, therefore, fielding those leads will be less systematic and less effective.

- Define your systems and processes.The best retail operations have defined selling systems already in place for handling in-store traffic. Processes should be developed and put in place for nonphysical leads as well. Systems define outcomes so, when defining your lead management systems, consider the best outcomes for nonphysical leads. To me, that means converting a high proportion of incoming leads into sales of larger average tickets, while at the same time delivering top customer experiences. If you are on board with this, you will want one of the following four outcomes for an incoming lead:

From this data, you will be able to see metrics such as traffic by lead type, revenue per lead, sales by appointment type, success rate of lead managers and sales associates.

• An immediate sale• An in-store appointment scheduled with an associate• An appointment scheduled virtually• An appointment scheduled in the customer’s homeYour systems and processes define your sales funnel, much like natural gas being directed to homes. Upon entering the funnel your leads need to be managed in a defined way. When they exit the funnel they should move in a desired, organized direction. This results in less waste. “The gas does not spill.” Instead, the flow is controlled and moved along. Here is a summary of how the lead process may work:• Lead (calls, chats, emails, texts, messages, web forms) enter the funnel.• Customer inquiries are answered by the leads manager and/or dedicated staff that reports to the lead manager. If for some reason the lead management staff is not available, information can be taken for a same-day response. Lead managers and lead associates should be as knowledgeable about your products and selling systems as any other salesperson in your organization. Designated salespeople who normally handle walk-in traffic can also take these incoming leads provided they are trained and monitored and follow processes as directed by the lead manager.• Customer leads need to be managed in a uniform way, similar to the following five common in-person retail selling systems steps.i) Start a conversation. Start with an approved greeting. Get all their information including name, where they live and contact information for follow up.ii) Understand the situation. Ask the right questions and collect all the information necessary (pictures and video are great).iii) Propose a solution. Solutions include an immediate purchase, a scheduled in-store appointment during the week, a scheduled virtual appointment or a scheduled appointment in the customer’s home. Note that in-store appointments should be transitioned from the lead manager to a sales associate or a designer of the sales manager’s choosing. All appointments should be hard-scheduled with an accepted calendar invite!iv) Conclude the sale. Get the right merchandise and services booked for the customer.v) Follow up. Follow up with the customer during the entire process at scheduled touch points. - Be ready for in-store or virtual appointments.Appointments are similar in many ways to making house calls in that sales or design associate preparation is critical. Ensure that they are prepared by having an understanding of the customer’s situation before the appointment. Have pictures, know how the room will be used and by whom (pets, children, number of people), ask about style/color preferences, when the merchandise is desired (custom and in stock), know budget and preference for financing (so approvals can be processed), even create sample room plans in advance. Treat in-store appointments as a VIP experience: think welcome package. Be Ready for Success!

- Track the lead process.Either use your ERP or a CRM as the hub of your process. This will enable task management and a central place to store notes. Control the pipeline of multiple leads through this “funneling” process. You can use various methods and platforms to communicate with prospects, but the interactions and tracking are best recorded in a central hub-like system. For example, if a chat comes in, it is recorded in the CRM or ERP hub. The appointment and follow-up are also recorded in the hub along with additional important information. Whether subsequent follow up happens via Facetime, in person, email, etc., all notes need to be maintained. This is a common work-in-process system. On its most basic level, the management system should track: To Do Tasks, Doing Tasks, and Done Tasks. By following this process, the management and tracking of information become an engine for growth.To generate a greater number of appointments and make your process as streamlined as possible, I recommend using a web based appointment system connected to your website and other sites (e.g., Instagram). This enables customers to book appointments with the desired sales associate at a time that suits all parties. Your manager can set the parameters of the available slots for sales designer associates. These systems help organize and make better use of everyone’s time.

- Metrics.Establish metrics for tracking the results of your lead management actions so you can achieve continuous improvement. Here are some metrics to consider tracking:a) Non-physical leads and sourceb) Who the lead was assigned toc) Leads with customer information vs. no informationd) Leads that result in a remote sale, an in-store appointment, a virtual appointment, no sale or a house calle) Sales associate assigned to lead via appointmentf) Results of appointments From this data you will be able to see metrics such as traffic by lead type, revenue per lead, sales by appointment type, success rate of lead managers and sales associates. You will also get an overall opinion of the value of managing your customer’s journey—starting with the real front door.

Upon entering the funnel your leads need to be managed in a defined way. When they exit the funnel they should move in a desired, organized direction. This results in less waste. |

Conclusion

With any new process there are always people who say “What if this happens?” or “That won’t work because of…” I say, there are exceptions to everything. Don’t create your standard operating processes around exceptions. Don’t hurt your future by holding on to the past. Move toward where you want to go. You will have a much better chance of getting there.

It is a fact that customers engage with businesses prior to showing up physically. This was true before COVID, it has been greatly expanded by COVID and it will continue to be the norm after COVID. My advice is to constantly improve upon systems and processes for managing your customer’s journey and ask the question: “How am I going to better manage leads though my pipeline and into my funnel?” For my part, I will continue to develop systems and processes for our industry and report my findings and suggestions in follow-up articles for Furniture World to help you maximize your potential and your customers’ experience.

In recent months our customers have spent more time at home than ever before. This has caused a demand spike for merchandise and services related to working at home. Grocery, home entertainment, home fitness, hardware, comfort clothing, building supplies, home spas, electronics, appliances, and home furnishings have benefited.

Thus far into this crisis, home furnishings retail has been a recipient of a diversion of consumer disposable income. How long this will last is uncertain. In my opinion, spending on furnishings is fragile. Unlike the home entertainment industry (video streaming, gaming), there is little that our industry has done to stimulate long-term demand. Likely, our consumers will continue to spend more on their homes until either their lives return to a more normal pre-pandemic lifestyle or their spending power diminishes. If demand falls off, some regions will be affected more than others, as happened in the recession that began in 2008. At that point, businesses that weather current challenges well will likely continue to prosper—similar to the most recent recovery period we experienced from 2010 until 2019.

Demand Vs. Supply

Shifts in demand are fairly common, the result of wars, natural disasters, man-made environmental problems, terrorism, and other unfortunate circumstances. These can cause the demand curve to move “to the right,” or increase, in some industries and “to the left” or decrease, in others. Generally, a sudden event causes more (or fewer) consumers to be in the market for certain goods. Following April 2020 we’ve seen the home furnishings demand curve move to the right, while the airline travel demand curve moved to the left. With these sudden shifts, shortages and excess supply occur. I believe that the demand curve for furniture is more price inelastic right now. That means that consumer buying behaviors are influenced less by price and more by availability. As home furnishings product shortages have occurred, more consumers have been willing to pay more for home goods.

Shortages

The two biggest challenges facing retailers right now are product and people shortages.

Product shortages have resulted from factory shutdowns, unavailable factory workers and supply chain disruptions.

Prior to the pandemic, when unemployment was at historic lows, finding and developing quality people was a top challenge. This situation has gone from bad to worse as fear of COVID-19 infection, increased unemployment benefits, low retail wages, and the perceived undesirability taking some retail furniture store jobs have made workers scarce.

Doing More With Less

Let’s examine a number of practices that can help you to weather the storm by doing more with less.

- Buy deep vs broad.With a smoothly flowing supply chain, a just-in-time, inventory replenishment strategy works well. You could buy “broadly” across all your merchandise categories and replenishing only when needed. However, with the erratic supply, all bets are off. The best bet may be to buy “deeper” across your very best SKUs. If you follow this strategy, ensure you have proven data on which items your customers want now. This strategy could backfire on you if you invest in untested product.

- Err on the side of over-inventory.Greater lead times equate to higher inventory levels. If your cash situation and warehouse capacity are such that you can carry a greater inventory percent to your sales volume than normal—you should do so provided you are buying the right merchandise. Do not make the mistake of over-investing in new product.

Consumer buying behaviors are influenced less right now by price and more by availability.

- Separate product into these two categories.Customers and salespeople will benefit from knowing what items are available today—either floor samples or product in your warehouse (the “available now” category). Customers who want something customized, or a fresh item (the “factory order” category) may choose a factory order subject to available production lead times. Ensure that after your greeting, you understand your customers’ reasonable timeline.For customers who choose to order new from the factory, be clear about lead times. Avoid giving delivery date ranges. To under promise and over deliver (UPOD) is generally a better practice. Instead of saying, “It’s going to be eight-ten weeks,” say, “Due to the current situation, to manufacture these new items for you, completion is maybe greater than two months.” You may also want to add a third product segment, “on-order” available to reserve.

- Continue selling after the sale.The sale begins when you write up a ticket, but that should not be the end. Whether you made an available-now sale or a new factory order, follow-up multiple times and re-sell. (Three proactive follow-ups at the minimum). To save everyone’s time, call your customers before they call you.

- Rethink markdown pricing.If you have a limited amount of inventory available to take home now, consider selling “drop” items (undamaged and visually like-new) at regular margins. Place a “take me home today” price tag on these items. Price, especially in an environment of product scarcity, is not the biggest factor with respect to consumer purchasing decisions.

- Seek balance in your vendor relationships.When the pandemic hit, some vendors were able to react fast, recalibrate their operations and ramp up production. Many have been struggling to react to the change in demand while keeping their workers safe. Everyone has been disrupted. It is more important than ever to focus on building quality relationships while at the same time cultivating new sources of supply. Unless you have a branded store, relying too heavily on one vendor may be risky. Not being important enough to any one vendor is also risky. Seek balance. Some domestic and regional vendors have been reliable in this current environment.

- Focus on appointment selling.Appointments between salespeople and customers allow for better use of the ultimate scarce resource— time. Whether an appointment is at a customer’s home or, better yet, in the store, both customer and salesperson should focus on accomplishing a result within a defined period, for example, one hour. Done right, appointments take fewer people and less time to produce a given sales volume. A number of stores have made the decision not to reopen their retail floors in pre-pandemic fashion. Instead, they’ve decided to continue to operate by appointment only.

- Guide your in-store traffic more efficiently.For those of you who believe that conducting business by appointment only is too radical a step for a brick and mortar furniture retailer, work to better control floor traffic. Continuous improvement in this area should be the goal of every showroom sales manager. To increase sales with fewer salesperson resources, managers must match customers to salespeople who are currently focused on other conversations. They must walk the fine line of moving salespeople between customers without causing frustration. Use technology to assist. Radios or app-enabled Bluetooth communication is necessary in most cases. Consider employing greeters (as opposed to CSRs) to direct customers to appropriate areas of the showroom if you often find yourself in open floor situations.

- Use price tags to tell a story.Price tags are not only about the price. They inform customers and remind salespeople about product and service options. Consider creating tags that show availability, additional product options, financing and services such as protection and delivery. With current technology it is simple to place a QR code on tags that link to product information, additional options and video. QR codes can even prompt a salesperson to come for assistance. This is already a reality in other industries, why not furniture?

- Direct virtual traffic more effectively.In the “New Front Door” article (July/August Furniture World), I explained how to capitalize on customer lead traffic. Doing this well helps you accomplish more with fewer people resources. Your objective should always be to make a meaningful connection with a prospect, then schedule a date and time to meet in-store. This way, your homework can be done in advance of a physical meeting, leading to a higher close rate, higher average sale and a happier customer.

- Leverage resources for follow-up.To do more with less, think about using automated emails, sending personalized text messages, and hiring staff whose sole purpose is to touch base with customers.

- Overstaff delivery and pay them well.In-home furniture delivery is a tough job. Arguably, compared to a UPS delivery person, furniture delivery is more physically and mentally demanding. Both compensation and staffing levels should be high enough to ensure that this vital function is performed well. Back-end DC positions are directly related to the speed of revenue in retail organizations.

- Practice LEAN internal merchandise flow.LEAN practices are now more important than ever. The nature of LEAN is to do more with less by constantly improving processes. Observe the ways in which you currently conduct activities such as receiving and delivery. Figure out what slows you down, then devise and document improved processes. If you can increase the throughput of merchandise via leaner activities, you make better use of your peoples’ time.

- Leverage technology for service issues.Reverse logistics, also known as “customer service problems after the sale,” can be time consuming and disruptive. A major strategy to do more with less is to control the work, rather than being controlled by the work. For example, using customer service technologies to make it easy for customers to enter their own warranty or protection claims on your website can enable a quicker and more productive response.

- Grow these two important close rates.Close rates from virtual leads and from in-store traffic are calculated as follows. They are indicators of your success at doing more with less.• Virtual lead to in-store appointment close rate = # of virtual leads / in-store appointments produced.• In-store close rate = # of visual traffic captured with door counter / # of sales.

- Review options for outsourcing roles.Here is a list of some of the roles in a typical home furnishings operation that can be outsourced: traditional marketing, digital marketing, content development, CFO / financial operations / accounting, HR, payroll, customer service, warehouse / delivery and repair. Outsourced partners should be specialists and be able to adapt to your business model. As with employees, an outsourcing partner can be successful or unsuccessful depending on their level of commitment, skill, personality, and desire to do the work properly.

Conclusion

From the time that this crazy ride started, many of us are just hanging on. It is complicated. It is exhausting. Take a moment, slow it down, look at your business, and consider how you can do more with less. Be honest with your situation and be open to trying new practices that give your employees and customers what they want. If you try, you might just get what you need. Enjoy your ride through this storm; surf well, so that when you break on through to the other side, you are ahead of your competitors.

Furniture World Magazine

Volume 150 NO 3 May/June

By David McMahon on 6/6/2020

The source and the management of every door to your operation, both virtual and physical, are critical elements for retail business success going forward.

The transition to the new front door is complete. From here on, brick and mortar have become a component of retail in some business models, but it cannot be THE definition of retail. The new “front door” for retail home furnishings business has become the place where shoppers first engage.

Over the past three months, retailers all over North America, have observed a huge shift in consumer behavior. This two-part article will discuss this shift and make suggestions regarding how Furniture World readers can and should adapt their business models.

Retail Never Shut Down

Retail sales never shut down over the past few months even though the buildings operated by “non-essential” businesses such as furniture stores closed.

Many brick and mortar retailers reading this may find it hard to believe that shuttered furniture stores generated significant sales volume during this period. In fact, some omni-channel ready retailers that previously generated a majority of sales based on walk-in traffic managed to generate sales volumes approaching normal levels. This was only possible for operations that were already functioning effectively before COVID-19. These retailers had the ability to ratchet up the digital aspects of their business to adapt and compete with e-commerce retail giants like Wayfair, whose sales exploded during this period.

By contrast, I believe that too many furniture and bedding retailers made the worst possible decision in recent months by posting “we are closed” messages on their websites and putting similar communications on their automated email replies and telephone recordings.

The Biggest Mistake

Retail should NEVER be closed, provided that there remains some capacity for communicating with customers and vendors, ordering product and delivering goods. Businesses that decided to shut down their entire lead funnel, saw sales go to zero.

Business operations are machines that run best while warm. Even those that kept operations going with minimal delivery, sales and service are getting back up to speed with greater efficiency. We can all learn from those who managed to stay running during the darkest time of the pandemic. Those retailers that went “dark” are having more trouble restarting.

Lessons Learned

- Customers still wanted to connect with retailers during dark times.The challenges people experienced while sheltering in place, including homeschooling and working from home, created new needs for home furnishings. That’s a big reason why customers continued to reach out to retailers who communicated that they remained ready and able to help people improve their home environments.

- Retailers benefited by aligning with the right suppliers.Throughout this period vendors and retailers faced similar challenges. Both were forced to change business processes overnight and supply chains were disrupted. Retailers who anticipated this issue, and expanded their inventory of bestsellers, were and are better positioned to adapt to supply chain shortages. Likewise, retailers that aligned with fewer, more reliable vendors are now better able to return to profitability. Good vendor relationships have proven to enable the extension of credit during times of physical retail closure. When reconsidering suppliers to adapt to your current situation you may want to refer to a previous article in this series, “How to Choose the Right Supplier” from the January/February 2019 issue of furniture World found at www.furninfo.com/Authors/David_McMahon/6

- Keeping key employees was a smart idea.Businesses that maintained their key managers and top performing sales and operations staff without a lay-off mostly managed to deliver and sell through this period. For a variety of reasons, at the time of this writing, many retailers are also in need of additional talent. Those that were not forced to furlough have fewer issues in talent acquisition. Some have chosen to give their people a bonus using forgivable PPP loan funds they have received.

- Doing the right thing was the right thing to do.During the current health crisis, many furniture retailers have extended support to front-line healthcare workers, leading to a heightened sense of community. Furniture and mattress businesses have donated product, time, even health supplies and equipment. They’ve also given gift cards to other local retailers hard hit by the pandemic. This created local goodwill for retailers who stayed engaged and involved locally, positioning them for a quicker rebound.

- Business process improvements made during the pandemic will yield big results.The pandemic accelerated the need for modifications to selling engagement systems, checkout processes, delivery, pick-up and service procedures. As well, owners and managers who kept their retail messaging current, plus accomplished tasks such as repricing, merchandising, training, and general organization, will be glad that they did.

- Retailers realized the benefits of peer support.Peer support has been critical to helping many companies navigate these challenging times. Our performance groups, for example, have met virtually, weekly, since the crisis emerged. The sharing of information about what has been working and how to deal with common challenges has drawn members closer together and, I believe, rescued several businesses.

- Appointment selling has become a powerful tool.“Appointment Selling” is the silver lining in this whole miserable experience. It is the one big competitive advantage that has emerged giving retailers with physical showrooms an advantage over the likes of Wayfair and Amazon. Retailers with both a physical and digital presence can let customers “test drive it before they buy it.” Sure, online-only retailers can provide 3D imaging and the ability to digitally insert items into photos of customer rooms, but that’s not the same experience. Appointment selling saves everyone time by matching a motivated buyer with a skilled salesperson or designer. Done well it helps shoppers make their purchase today — and remain satisfied tomorrow.Home living and sleep products are an essential product/service, especially in today’s stay-at-home economy, which is unlikely to return to pre-pandemic ways of living, business and travel any time soon. Appointment selling has allowed many retailers to safely do business with serious customers who need the essential service that home retail enables. Motivated buyers interacting with professional sellers of home goods have caused close rates to increase to between 60 and 100 percent. Along with this increase, average sales have grown, probably due a greater focus on helping consumers solve their needs in fewer visits.I see this trend continuing and I believe it should be tracked and marketed accordingly.

- Increased reliance on social networking.Facebook has become more powerful as retailers continue to rely on its unmatched social platform. Those retailers that cultivated an established following prior to the crisis have been able to successfully introduce appointments, auctions, and videos to generate business.

- Digital marketing has taken over.Digital marketing has taken over from traditional media as the dominant consumer-facing media in retail. Over the years, I have joked with retailers that if they ever wanted to know which media really works, they could shut everything off except for one media type and see what happens. During this crisis, this is exactly what many operations did. They shut down all but select digital media. The result for many was that the returns on ad spend went up considerably. In some markets, however, for retailers with a history of broadcasting niche-style messages over traditional media, increased impact was achieved among people who were stuck at home in front of the TV.

- Lead management should be tracked from the source.Portals such as Podium, Perq, Chat, and the good-ole telephone are now being described as “the new front door.” This is where the journey or first connection between customers and retailers occurs. This first contact is where retailers should register their “up.” Prior to the crisis, and even now, “traffic” meant shoppers entering through a physical doorway. Retailers are pretty good at measuring physical door (last door) swings, The “first door” most actually enter through (website engagement, chat, telephone) has been haphazardly monitored by most. The revelation here about the “new front door” is that the source and management of all doors, virtual and physical, has become a critical element for businesses going forward. Furnishings retailers must, therefore, develop systems processes for shoppers who enter through any door by using “Customer Journey Management.” This is the term I use for walking the customer through the various stages of a purchasing system. For retail home furnishings, this encompasses more than CRM (customer relationship management) due to the unique characteristics of buying and delivering home furnishings.

Next Issue

The next article in this series will explore the connections between “Customer Journey Management,” “Appointment Selling” and “The New Front Door” to look at how you can take advantage of a paradigm shift that has occurred in retail. Until then, remember that an omnichannel retailer, a truly essential retailer, is never closed. Don’t go dark, ever.

The below article is based on a study I did a couple of years ago. It is mostly valid today.

By David McMahon

Improvement starts with awareness and desire. The awareness of how you are performing against standards allows you to understand your strengths and weaknesses. It is through the measurement against these standards, or metrics, that you can find your gaps. Knowing your gaps and then having the desire to create a strategy and act upon an improvement plan is what separates average and top business managers.

For the good of the industry and to assist home furnishing retailers in improving their individual operations, we are publishing the financial portion of our performance observations during 2017.

During the course of 2017, I reviewed a wide-range of operations through our consulting and performance groups activities. In doing so, I established a set of metrics that I consider to be an excellent source for use in benchmarking against average and high-performers.

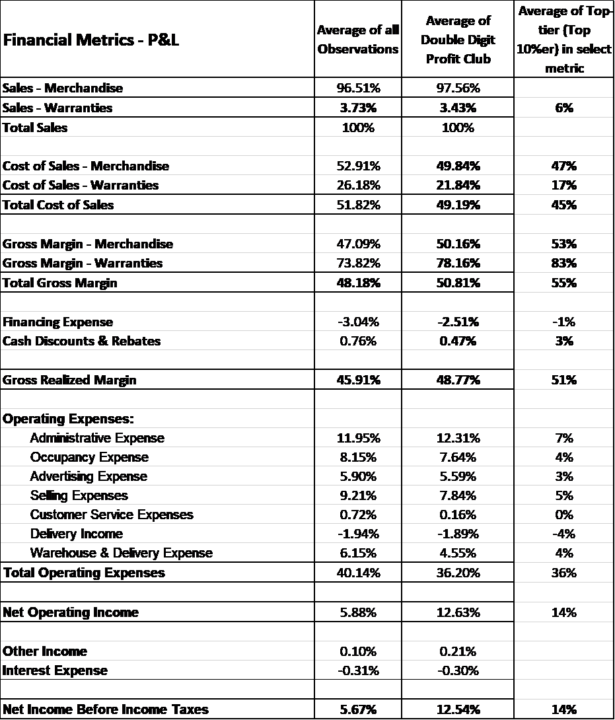

Below I am releasing the Profit and Loss (P&L) percentages observed. Following this I’ll give my interpretation. These numbers are broken down by what is the commonly accepted P&L format amongst industry retailers. The observations are expressed in 3 columns. The first 2 columns produce P&L’s averages. The 3rd column is used to show the top percentages in select metrics. These are the 3 column groupings:

- Average performers

- Average of Double Digit Profit Club (Net-income before tax) performers

- Average of Top-tier performer for each metric (Top 10%er suggestion)

The observations are expressed in terms of percentages of

total retail sales volume. This allows

for operations of different sizes to compare themselves using a “common-size”

format. For the purposes of

compatibility as well, we excluded electronics and appliances merchandise from

the metrics.

Financial Metric Observations:

Financial Metric Interpretation:

Here are my comments on the above numbers:

- Sales

- Separating the percent of warranty and protection sales with respect to merchandise sales is now the accepted way of producing an industry P&L. This is due to the massive importance of increasing the proportion of warranty sales. They are typically the highest gross margin product that a retailer sells.

- The range of average and double-digit operations in % of warranty sales to total sales 3.73 % and 3.43 %.

- Top-tier operations in warranty sales almost double these averages. Their customers spend 6% of their dollars on warranty and product protection.

- Cost of Sales

- This is a prime area where the double-digit profit club outpaces average performers.

- With respect to cost of merchandise, double-digit profit operations had a 3% lower cost of goods % than an average operation.

- The top-tier performers actually even had almost another 3% cost advantage over the double-digit profit operations at 47%.

- A similar pattern occurred with cost of warranties. Better operations are trained and follow systems to sell on value rather than sell on price in my opinion.

- Gross Margin (GM)

- Gross margin percent of sales is just the inverse of cost of goods. So, the operations with the lower cost have the highest margin.

- This data supports the prior 2 years of formal studies we conducted with the HFA (Home Furnishings Association). Average performers show a 48.18% GM. The double-digit club gets almost 51% GM. While top-tier performers achieve 55%.

- These numbers are real! And, wherever you are with GM, believe that you can improve. I’ve personally helped move this number with clients many times by over 10% while simultaneously growing sales volume.

- Gross Realized Margin

- The generally accepted way of producing an industry P&L is by showing a second gross margin line called Gross Realized Margin. This first lists the reduction of costs by vendor rebates and discounts incurred. Then, it increases cost of sales by finance and credit card fees.

- It gives an alternate gross margin number as non-employee direct costs with purchasing the merchandise and making the sale are considered.

- There is a similar step-up in GM % with the 3 groups observed. So before any operating costs are considered, an average operation has 45.91% of sales dollars left to produce a profit. The double-digit profit club has almost a 3% lead already in the race for net-income.

- Administrative Costs

- Admin costs include general overhead expenses such as: Office and owner payroll, training, legal, accounting, travel, meals and entertainment, markets, software, and all other items that do not fall under occupancy, advertising, selling, distribution, and service.

- We find that on average operations spend around 12% of these sales volume on administration of their business.

- We see a ride range with this metric. It often is effected by the number of locations, the number of family members in the business, and of course with how lean an operator runs. The top-tier in this metric came to a very low 7%. In fact this may even be a bit too low for some. I feel that if an operation is under 10% here and can manage their work properly they are doing exceptionally well.

- Some operations here, in fact do not want to be too low as they feel they cannot provide properly for their employees. Certain owners feel that it is important have a proper amount of spend in admin areas such as health care, training, and technology to remain relevant to in the marketplace.

- Occupancy Costs

- These include all brick and mortar showroom facility costs such as rent, loan expenses, real estate charges, maintenance, and utilities.

- This is typically one of the most fixed costs a brick and mortar retailer incurs. It does not change that much from month to month. Whether sales go up or down, the rent, maintenance and utilities are pretty similar dollar-wise. However, as a percentage, as sales grow these cost fall and result in a positive impact to the bottom-line net income. This is one of the reasons why high performing sales floors produce so much more profit than average performers.

- Average occupancy is 8.15% of sales. The double-digit profit club is 7.64% and the select top-tier performers in this metric are as low as 4%.

- Advertising Expense

- An average operation runs 5-6% of sales. Depending on the location however a profitable business is possible up to even 10%. I’ve seen higher of course, but not too many that actually made much money above that.

- Oftentimes, it is good to consider occupancy and advertising expenses together percentage-wise. Whatever your mix, it is highly advisable to keep the combined percentage under 15% of sales.

- Selling Expenses

- Selling expenses cover sales managers and sales people’s wages, bonuses, commissions and other payroll costs. Sales training, outside design contactors, point-of-sale material may all be included here as well.

- I commonly see operations in the 5% – 10% range. This data is consistent. Average stores are at 9.21%, the double-digit club is at 7.84% while the top-tier in this metric is at 5%.

- This cost should be mostly a variable cost. That means that when sales go up or down selling costs should go up or down as a dollar amount and remain constant as a percentage. I do not mind if this cost is on the high side for any one client as long as their GM % is also on the high side.

- Customer

Service Expense

- This is actually a net percentage. It represents all customer service costs that are related to solving issues with damaged and defective merchandise. It includes any dedicated employees and the costs of repair. Costs are reduced by any income or amounts in credit that are received back as compensation from vendors.

- A highly functional operation has very low service costs as a net percentage.

- Delivery Income

- This P&L breaks out delivery income as a separate line item from warehouse and delivery activities. It should be the goal of an operations to collect an appropriate amount that covers the direct delivery related expenses. Otherwise, delivery costs come straight out of gross margin dollars.

- On average operations seem to collect around 1.9% of sales in delivery income. However, the top-tier performers in this metric collect double that.

- Warehouse and Delivery Expense

- These costs include all physical merchandise handling and logistics employees, their operating facilities, their equipment and any other resources they use.

- On average operations spend 6.15% of sales here. The double-digit profit club uses 1.6% of sales less cash resources at 4.55% of sales. Top-tier performers are as low as 4% of sales.

- Total Operating Expenses

- Total Operating Expenses add up all expenses that are reduced from Gross Realized Margin. It is total of Admin, Occupancy, Advertising, Selling, Service, Delivery, and Warehousing.

- Whenever I see an in-control operation that is running smoothly, without chaos, with a total operating expense ratio of under 40% of sales, I think: Potential Goldmine.

- Average performers are at 40.14% while the double-digit profit club is very lean at 36.2%. I don’t get alarmed when I encounter an operation at 42% or 43% provided they are spending in areas that add value to their business and employees. Operations who are close to 50% in this metric are usually pulling out profit early or are running a broken business model.

- Net Operating Income

- This is the percent of every sales dollar that remains after all costs of goods and regular operating expenses are deducted.

- Average operations show 5.88% Net Operating Income. The double-digit profit club has more than 100% more profit at 12.63 % Net Operating Income. And, the select top-tier operations for this metric have 14%.

- Net Income before Tax

- This is the bottom-line. Other non-operating income, non-operating expenses and interest expenses are added and deducted. Typically, there is little in either category with the exception of those operations that rent out part of their facilities or who are carrying a large debt and paying significant interest.

- Overall the bottom-line is not significantly different from Net Operating Income. Average operations show 5.67% Net Income before tax. The double-digit profit club has 12.54 %. And, the select top-tier operations for this metric still have a 14% bottom-line.

When I discuss improvement possibilities with business people, they are sometimes skeptical. Sometimes they don’t believe me when I say, you can grow gross margins by 8% of sales. Or that they can increase sales volume by 25%. Or, they can grow profits by 7% of sales. Or, they can double their cash position. Not everyone believe me — at first. It is true for many that vast improvement opportunity exists. I’ve seen it happen time and time again. I’ve been a part of it. I hope that these metrics inspire you to look at your business analytically. I hope you are motivated to seek action to reach new heights.

In our 2017 Retail Observations we also looked at several selling and inventory metrics. These will be published in another well respected industry publication: Furniture World and made available along with these Financial Metrics to the members of the HFA.

Finally, for a limited time, we will be offering retailers an Opportunity Analyzer. You can get a customized side-by-side comparison report with all these metrics. Plus you can get a one-one web-meeting. In the web-meeting we will present and discuss our observations and your opportunity. Just contact me if interested in getting some guidance with improving your profitability and cash flow.